Standard payroll deductions calculator

Form TD1X Statement of Commission Income and Expenses for Payroll Tax Deductions. Total annual income Tax liability All deductions Withholdings Your annual paycheck Thats the five steps to go through to work your paycheck.

What Are Payroll Deductions Article

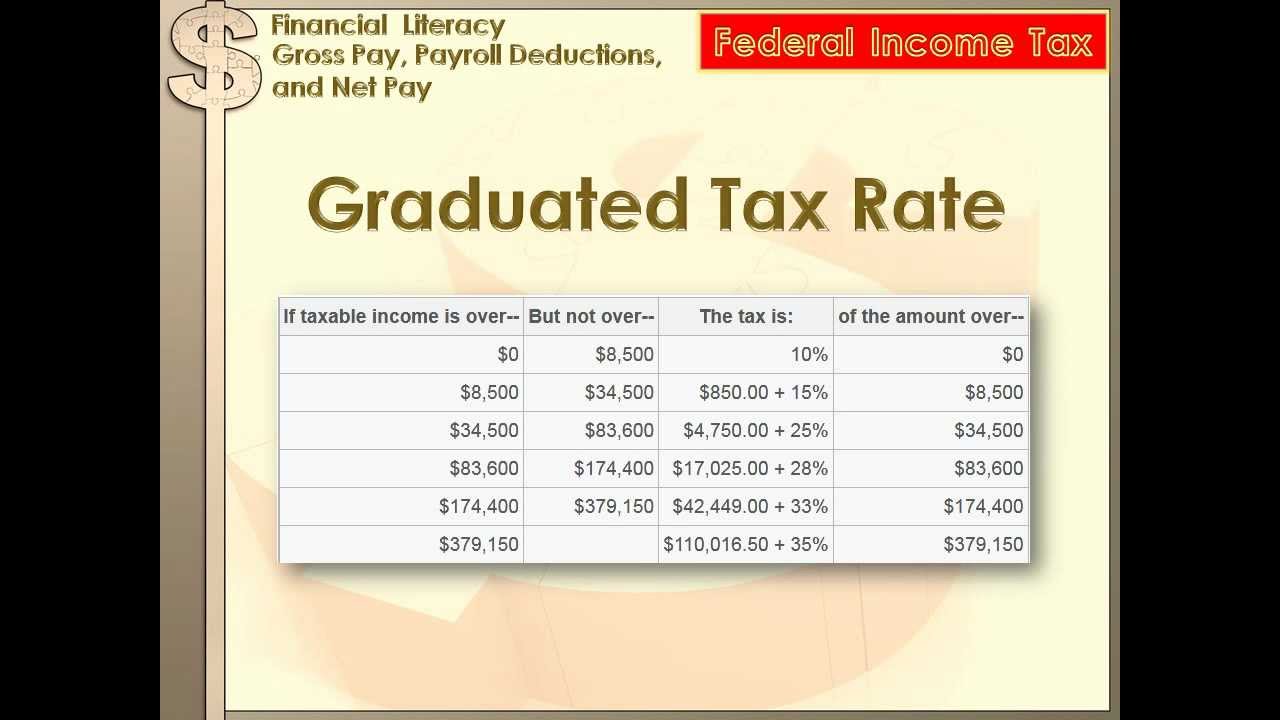

Payroll tax deductions are a part of the way income taxes are collected in the US.

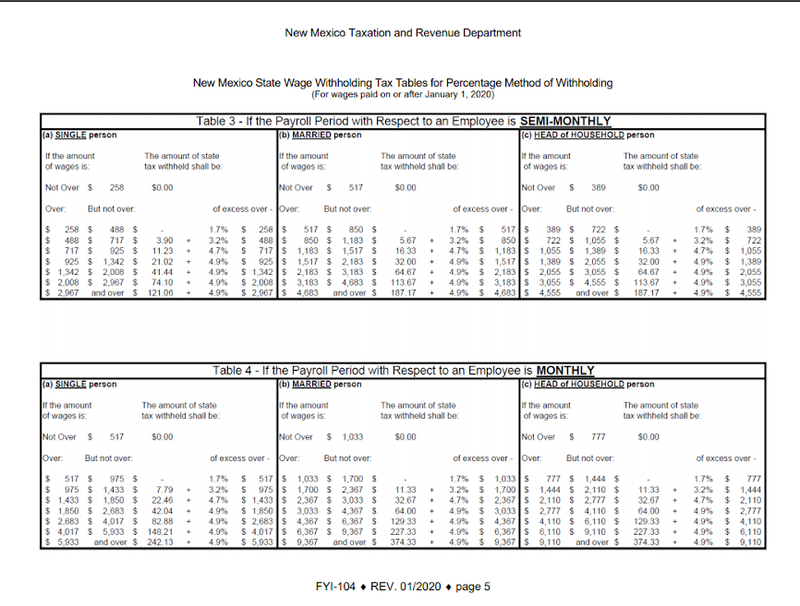

. To calculate the payroll based on hourly requirements the organization also needs the rate assigned to the various classes of employees or workers. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

TDS is calculated on Basic Allowances Deductions 12 IT Declarations Standard deduction Standard deduction 50000 New. This calculator allows you to enter you monthly income for each month throughout the tax year. To calculate your annual salary multiply the gross pay before taxes by the number of pay periods in the year.

Calculate your net paycheck after payroll deductions using this calculator which helps you see the effect of changing your tax withholding information filing status retirement deductions. Estimate your federal income tax withholding. Our calculator will calculate gross pay.

How to use a Payroll Online. The calculator then provides monthly PAYE and NI deductions and an annual figure overview. Our free payroll tax calculators make it simple to figure out withholdings and deductions in any state for any type of payment.

This free paycheck calculator makes it easy for you to calculate pay for all your workers including hourly wage earners and salaried employees. Payroll Deductions Online Calculator Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions. Withholding schedules rules and rates are from IRS Publication 15 and IRS Publication 15T.

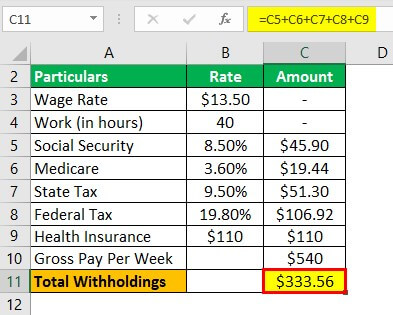

Employers can use it to calculate net pay and figure out how. Payroll deductions are wages withheld from an employees total earnings for the purpose of paying taxes garnishments and benefits like health insurance. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

Use this calculator to help you determine your net paycheck. Ad Shouldering the Burden of Doing Payroll Can Distract You from Your Main Duties. Use this simplified payroll deductions calculator to help you determine your net paycheck.

A payroll deductions online calculator lets you calculate federal provincial and territorial payroll deductions for all provinces and territories except Quebec. For example if an employee earns 1500 per week the individuals annual. When you work at a job a part of your income is taken each pay period based on a number of.

If the worker has. Withhold half of the total 765 62 for Social Security plus 145 for Medicare from the employees paycheck. Full payment flexibility for your team across 120 currencies and 10 payment methods.

Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an employer. Youll first need to know how much of the staffs monthly pay is deductible by tax. Heres a step-by-step guide to walk you through.

Deductions are the sum of PF ESI and PT etc. Use this tool to. To figure out your California payroll withholding and federal payroll taxes just enter wage and W-4 allowances for each employee below.

How It Works. See how your refund take-home pay or tax due are affected by withholding amount. You need to do these.

Taxable income Monthly Basic Pay Overtime Pay Holiday Pay Night. Ad Shouldering the Burden of Doing Payroll Can Distract You from Your Main Duties. Payroll Deductions Comparison Calculator Definitions Pay period This is how often you are paid.

Payroll Deductions Calculator Fine-tune your payroll information and deductions so you can provide your staff with accurate paychecks and get deductions right. Form TD1-IN Determination of Exemption of an Indians Employment Income. For a hypothetical employee with 1500 in weekly pay the.

For example if you earn 2000week your annual income is calculated by. Full payment flexibility for your team across 120 currencies and 10 payment methods. Weekly 52 paychecks per year Every other week 26 paychecks per year.

How To Calculate Payroll Taxes Futa Sui And More Surepayroll

Payroll Tax Calculator For Employers Gusto

How To Calculate Taxes On Payroll Outlet 58 Off Www Ingeniovirtual Com

How To Calculate 2019 Federal Income Withhold Manually

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

Payroll Formula Step By Step Calculation With Examples

Tax Deduction Calculator Sale Online 50 Off Www Ingeniovirtual Com

How To Use The Cra Payroll Deductions Calculator Blog Avalon Accounting

Federal Withholding Calculator Store 51 Off Www Ingeniovirtual Com

Mathematics For Work And Everyday Life

Financial Literacy Gross Pay Payroll Deductions Net Pay 8th Grade Math Youtube

How To Calculate Taxes On Payroll Outlet 58 Off Www Ingeniovirtual Com

Tax Calculator With Deductions Outlet 50 Off Www Ingeniovirtual Com

How To Calculate Federal Income Tax

Calculation Of Federal Employment Taxes Payroll Services

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Calculation Of Federal Employment Taxes Payroll Services